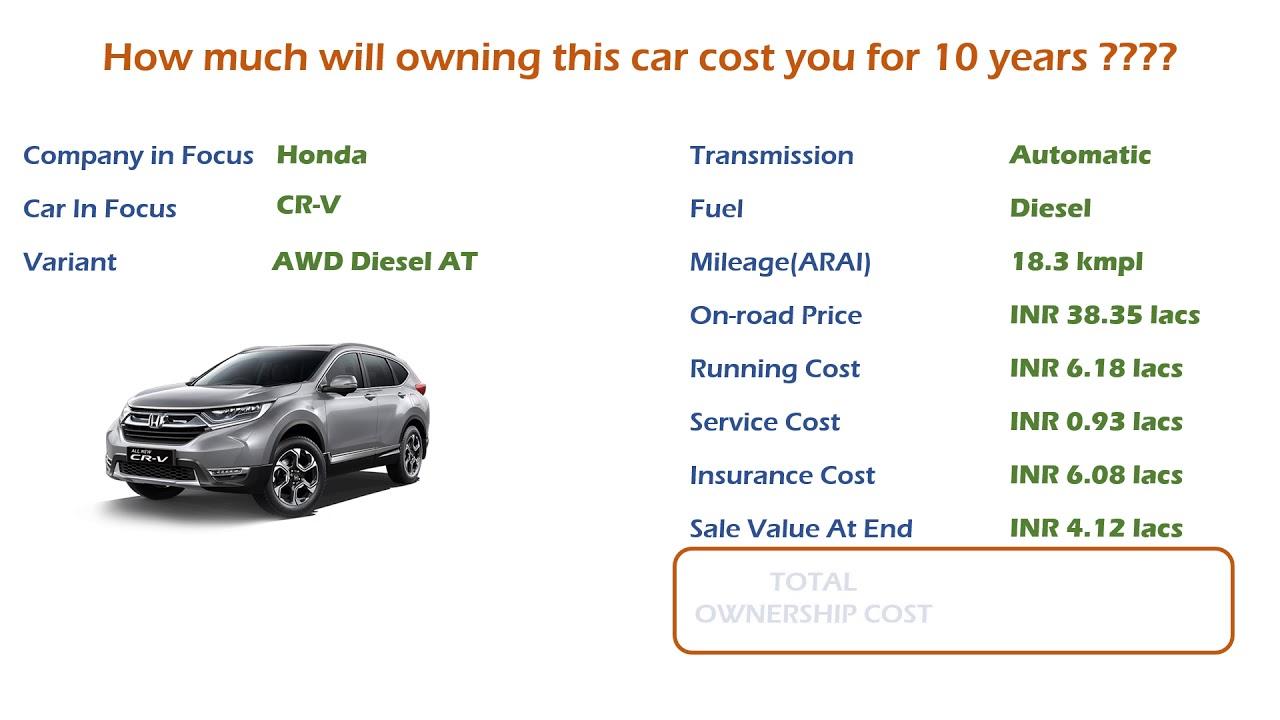

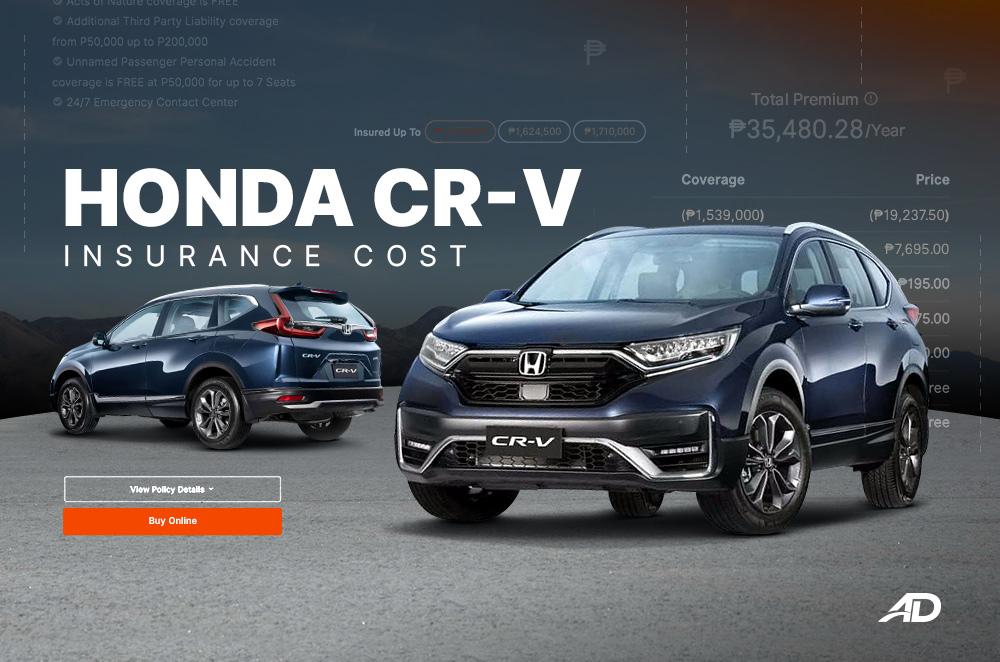

Honda CR-V insurance costs

When it comes to finding the perfect balance between practicality, reliability, and comfort in a compact SUV, the Honda CR-V ofen rises to the top of many drivers’ lists. Wiht its spacious interior, impressive fuel efficiency, and reputation for durability, this versatile vehicle has carved out a loyal following. however, owning a car goes beyond just the purchase price. One of the critical considerations for any potential CR-V owner is understanding the insurance costs associated with this popular model. In this article, we will delve into the factors that influence Honda CR-V insurance rates, explore average costs across diffrent demographics, and offer insights to help you make informed decisions about your vehicle’s protection.Whether you’re a first-time buyer or a seasoned CR-V owner,knowing the ins and outs of insurance costs will help you steer your way through the complexities of car ownership with confidence.

Understanding the Factors Influencing Honda CR-V Insurance Premiums

The insurance premiums for the Honda CR-V can vary substantially based on several key factors.Understanding these elements can empower owners and prospective buyers to make informed decisions. Age of the Driver, as a notable exmaple, plays a crucial role; younger drivers frequently enough face higher premiums due to perceived risk. Additionally, Driving Record is vital—clean driving histories can lead to substantial discounts, while any history of accidents or traffic violations will raise the rates. The location where the vehicle is primarily parked also impacts costs, as urban areas tend to have higher theft and accident rates compared to rural settings.

Moreover, the model year and trim level of the Honda CR-V can influence premiums. Newer models equipped with advanced safety features typically attract lower insurance costs due to less likelihood of accidents. Moreover, annual mileage plays a part; vehicles driven extensively on a daily basis may incur higher rates due to increased exposure to potential risks. the insurance provider chosen can make a notable difference, as each company assesses risk factors differently and offers varying discounts.

Comparative Analysis of Coverage Options for Honda CR-V owners

When it comes to choosing the right insurance coverage for your Honda CR-V, understanding different options is key to not only securing your vehicle but also ensuring your financial peace of mind. There are several coverage types available, each varying in premium costs and the protection they offer. Typically, owners can opt for:

- Liability Insurance: Covers damages to other vehicles and injuries to others in the event of an accident.

- Collision Coverage: Pays for damage to your own vehicle after a collision, irrespective of who’s at fault.

- Thorough Coverage: Offers protection against non-collision incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

To assist owners in making informed decisions,a comparative analysis of the average costs associated with these coverage options can be beneficial. Below is a brief overview that outlines typical annual premium estimates:

| Coverage Type | Average Annual Cost |

|---|---|

| Liability Insurance | $800 |

| Collision Coverage | $600 |

| Comprehensive Coverage | $500 |

| personal Injury Protection (PIP) | $300 |

This table illustrates the distinction in costs and the meaning of each type of coverage tailored specifically for the Honda CR-V.The variety of choices allows owners to weigh their priorities, be it budget vs. protection, helping them determine the most suitable insurance blend.

Tips for Reducing Insurance Costs for Your Honda CR-V

Reducing insurance costs for your Honda CR-V can be both an art and a science. Start by shopping around for the best rates from multiple insurance providers. Each company evaluates risk differently, so a quote from one insurer may differ significantly from another. Additionally, consider increasing your deductibles; while this means a higher out-of-pocket cost in the event of a claim, it often results in lower monthly premiums. Don’t forget to inquire about available discounts for factors such as being a safe driver, bundling multiple policies, or even completing a defensive driving course.

Regular maintenance and care for your Honda CR-V can have a positive impact on your insurance premiums as well. Keeping your vehicle in excellent condition not only helps avoid accidents but can also qualify you for safety and anti-theft discounts. Always ensure that your car is fitted with updated safety features, as newer models often come equipped with technology that can lower your risk profile. Lastly, consider your annual mileage; driving less can result in significant savings on your insurance, so carpooling or using public transport when possible can be beneficial.

Evaluating the Long-Term Value of Insuring your Honda CR-V

When considering the long-term value of insuring your Honda CR-V, it’s essential to evaluate both the financial and practical benefits of maintaining robust coverage. Even though the upfront costs may seem daunting, having comprehensive insurance can protect you from significant out-of-pocket expenses in case of accidents, theft, or natural disasters. Here are some factors to consider:

- Peace of Mind: Knowing that your vehicle is well-protected allows you to enjoy your rides without the constant worry of unforeseen events.

- potential Resale Value: A well-maintained CR-V with a solid insurance history can retain its value over time, making it more attractive to potential buyers.

- Safety Features and Discounts: Many insurance companies offer discounts for vehicles equipped with advanced safety features, which the Honda CR-V typically possesses.

On the flip side, regular assessment of your insurance premiums and coverage options is vital for optimizing value. Car insurance rates tend to fluctuate over time, so it may be beneficial to shop around periodically. Additionally, an evaluation of your driving habits, mileage, and changes in the local area (like crime rates) can also offer insights into potential savings. Here’s a swift comparison of typical insurance factors:

| Factor | Impact on Insurance Costs |

|---|---|

| Driving History | Better history typically lowers premiums |

| Annual Mileage | Lower mileage can reduce costs |

| Location | High-crime areas may increase rates |

| Insurance Type | Comprehensive coverage is more expensive |

Key Takeaways

understanding the insurance costs associated with the Honda CR-V is essential for prospective buyers and current owners alike. With its blend of reliability and advanced safety features, the CR-V often proves to be a cost-effective choice in terms of coverage. By weighing factors such as your driving history, location, and the specific model you choose, you can better navigate the insurance landscape and find a policy that fits your budget and lifestyle.As you embark on your journey with this popular SUV, remember that informed decisions can lead not only to peace of mind on the road but also in managing your overall expenses. Embrace the adventure ahead, knowing that you’ve taken the necessary steps to protect both your investment and your drive.